Noticias

EUROPE - International tax planning and structuring – issues to be considered to avoid risks

marzo 2019

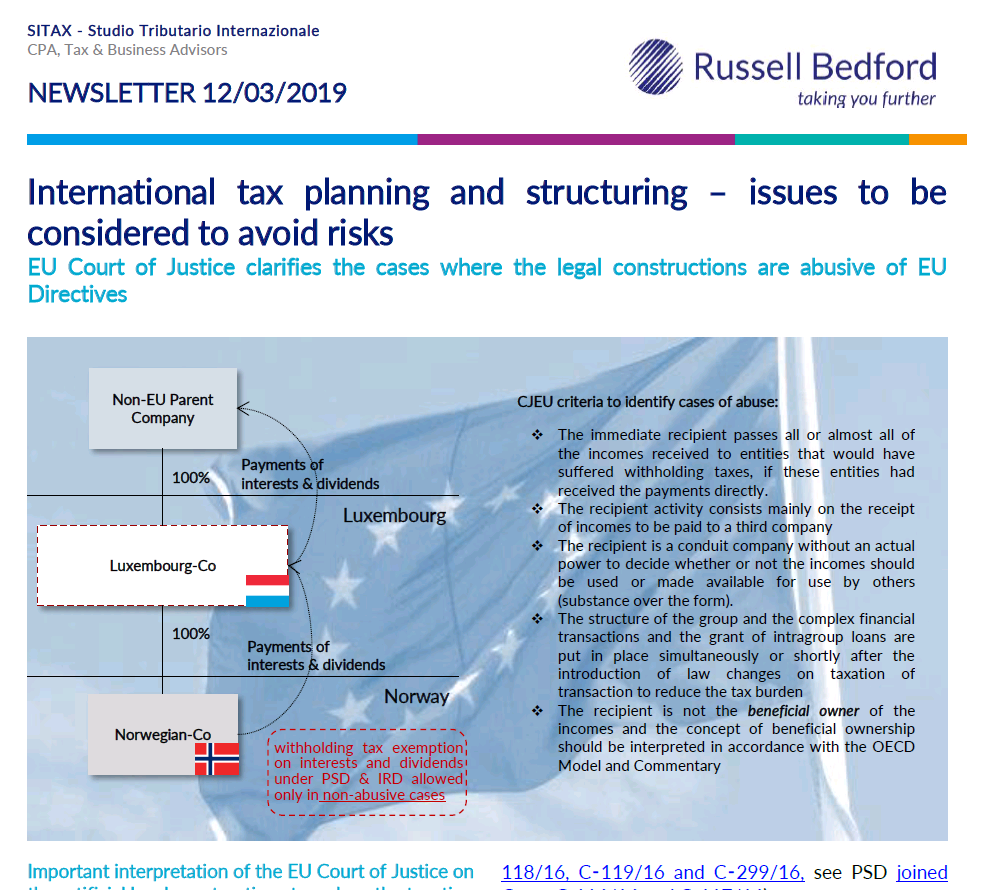

Important interpretation of the EU Court of Justice on the artificial legal constructions to reduce the taxation of group

In a group of company and under certain conditions interests, royalties and dividends paid by an European company (EU-Co) to another EU-Co are not subject to withholding taxes, in accordance with the rules of Parent & Subsidiary (PSD) and Interest & Royalties (IRD) Directives. The benefits of these rules are legally applied in group of companies, but it is extremely important to ascertain if the transactions are eligible for the benefit, in order to avoid to trigger risks connected with abusive behaviours.

International tax planning and structuring are essential components for a successful business and most of the tax strategies leverage also PSD and IRD Directives, but it is crucial to avoid to trigger risks related to the wrong interpretation of the mentioned Directives.

Therefore, within the scope of these EU Directives, the concept of abuse should be very clear to avoid aggressive tax planning or unexpected risks. In this respect the interpretation principles rendered by the Court of Justice of the European Union (CJEU) on February 26th, 2019 are extremely important (see IRD joined Cases C‑115/16, C‑118/16, C‑119/16 and C‑299/16, see PSD joined Cases C-116/16 and C-117/16).

With these cases the CJEU identified the criteria for assessing if the flow of dividends and interests, paid by an EU company to another, is qualified to obtain withholding exemption under the mentioned Directives.

For further information, read the entire article by clicking on the following PDF:

(*) This publication contains information in summary and it is just a general guidance. We do not accept any responsibility for loss to any person acting or refraining from action as result of any material in this publication. This publication should not be relied on as a substitute for professional advice.